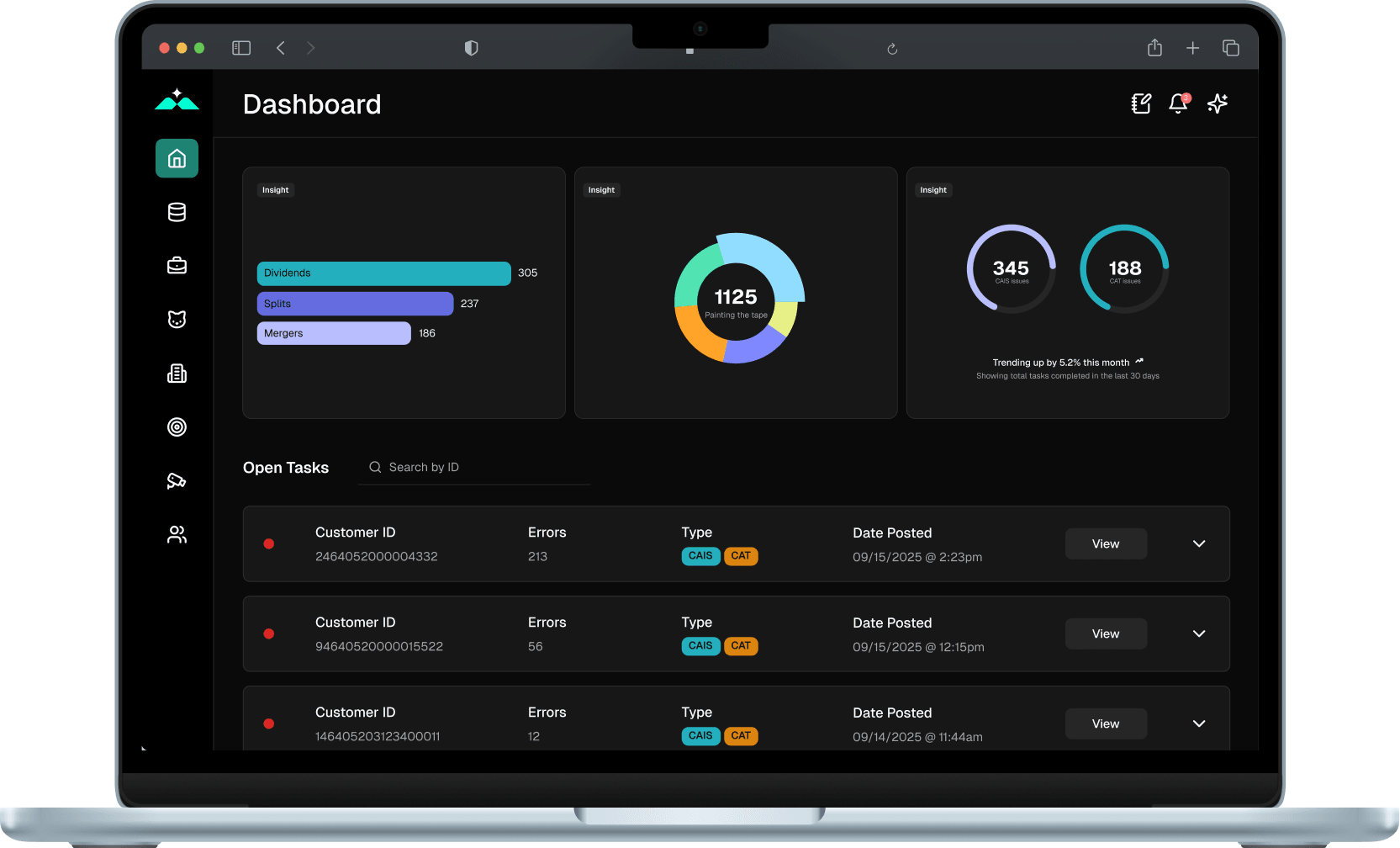

Platform

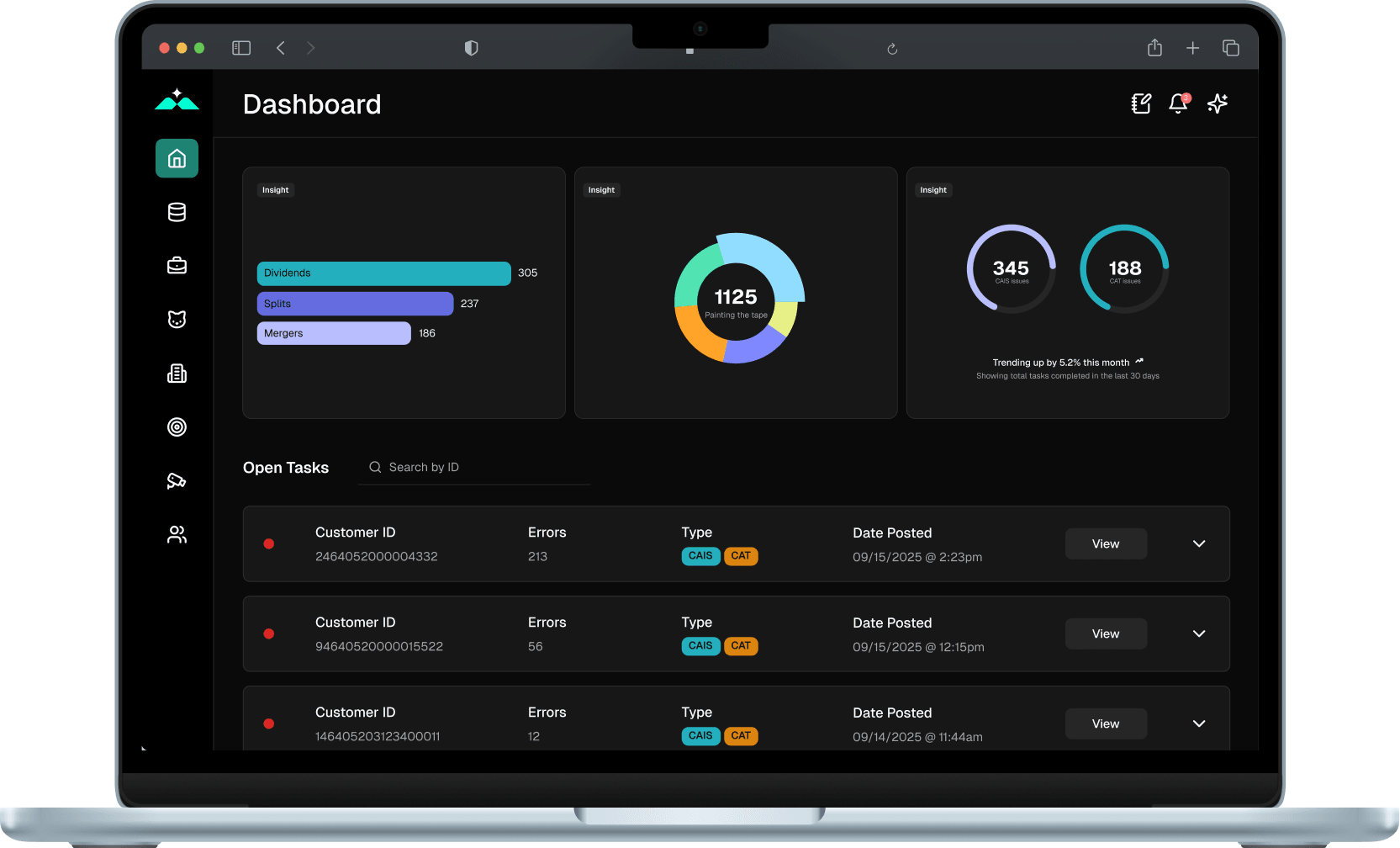

The Unified AI Platform Powering Operations & Compliance for Financial Institutions

Everything you need to manage trade reporting, best execution, surveillance, corporate actions, and data reconciliation - all in one intelligent platform.

Trade Reporting (CAT/CAIS)

Automated Regulatory Reporting

Never miss a regulatory deadline again. New Range automatically collects trade data, validates formats, identifies exceptions, and submits reports to FINRA CAT & CAIS.

Key Benefits

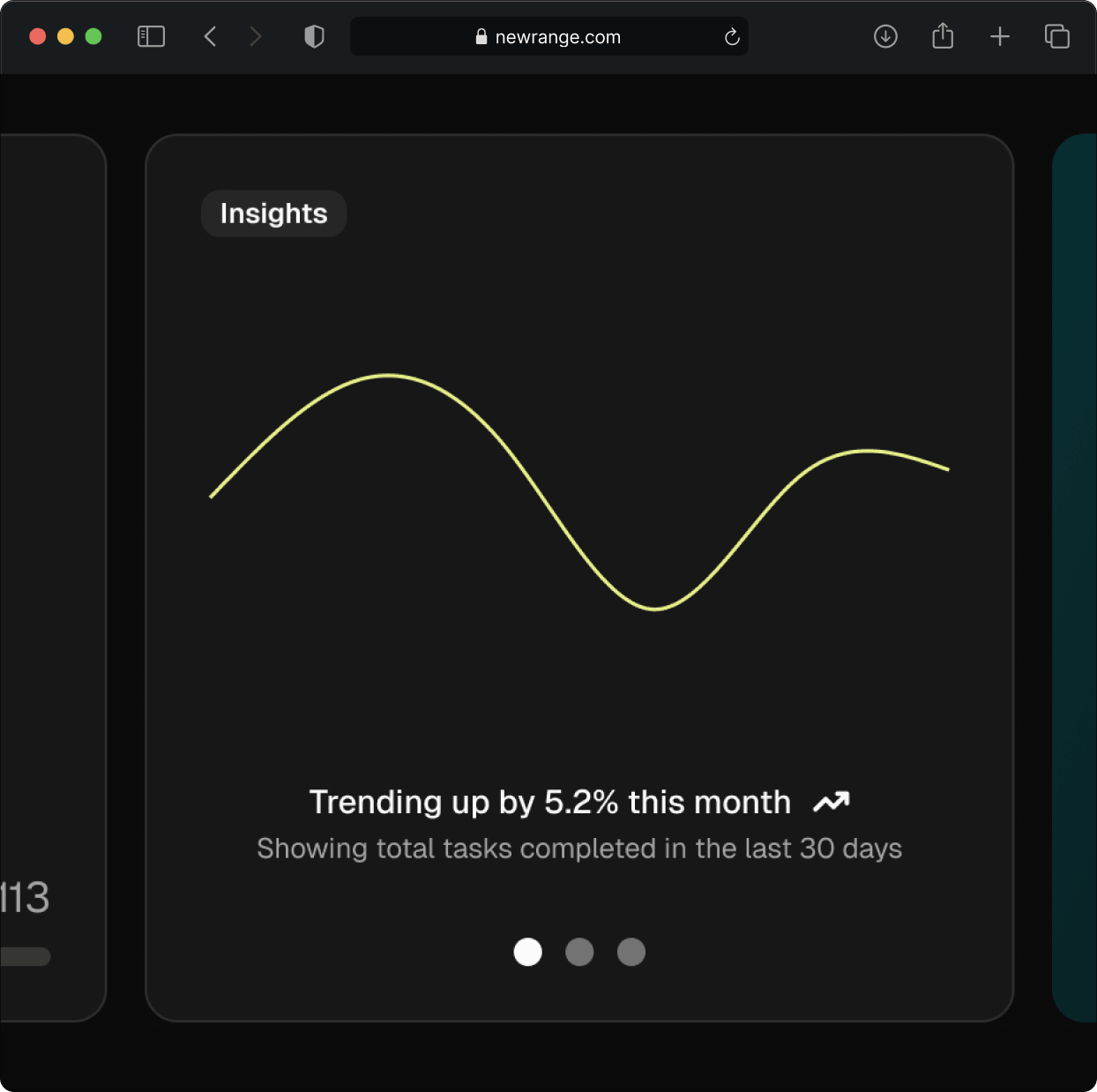

Best Execution Analysis

Demonstrate Regulatory Compliance With Robust Analysis Tools

Best execution is a fundamental regulatory obligation for broker-dealers. New Range provides the most sophisticated analysis tools to monitor, analyze, and document your best execution program.

Key Benefits

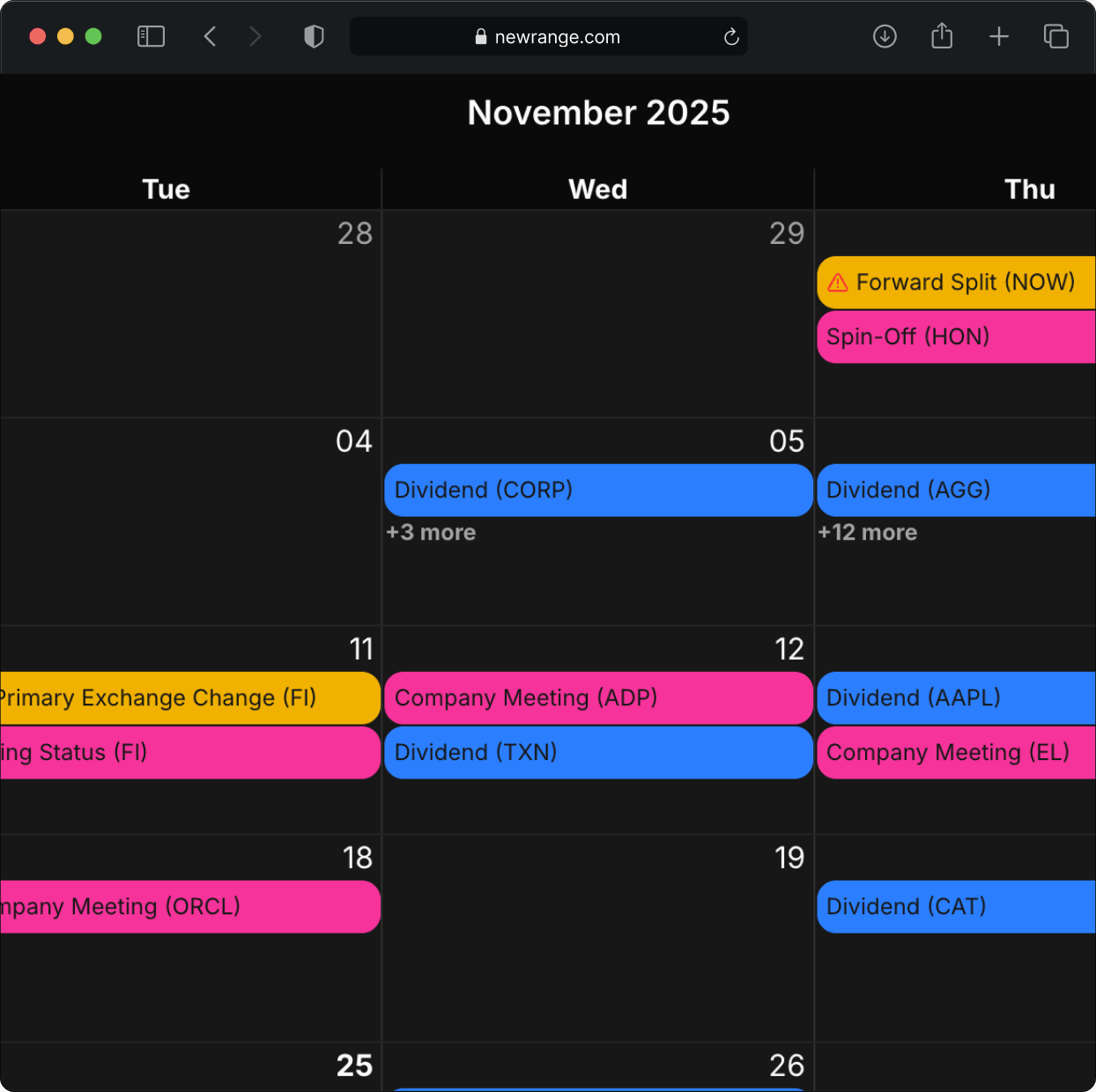

Corporate Actions Management

Automated Event Processing

Corporate actions errors can cause major operational and compliance risks. Missed entitlements, incorrect dividend payouts, and processing errors damage client relationships and trigger regulatory scrutiny. New Range automates corporate action management from announcement through final allocation

Key Benefits

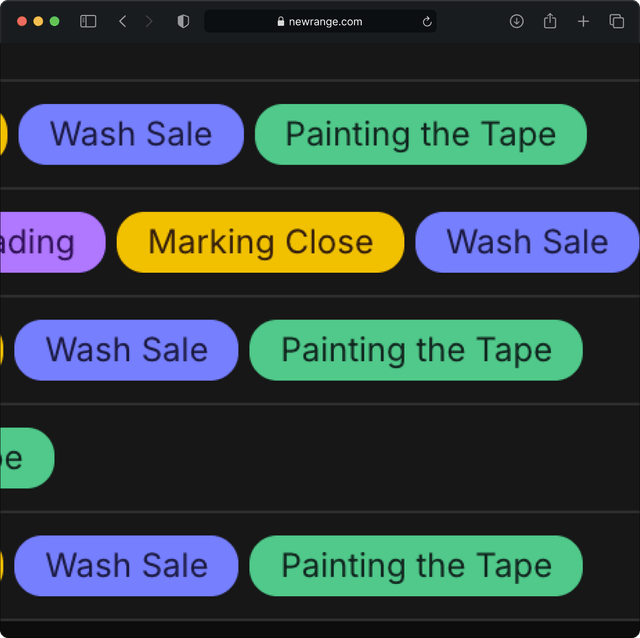

Trade Surveillance

Demonstrate Regulatory Compliance With Robust Analysis Tools

Best execution is a fundamental regulatory obligation for broker-dealers. New Range provides the most sophisticated analysis tools to monitor, analyze, and document your best execution program.

Key Benefits

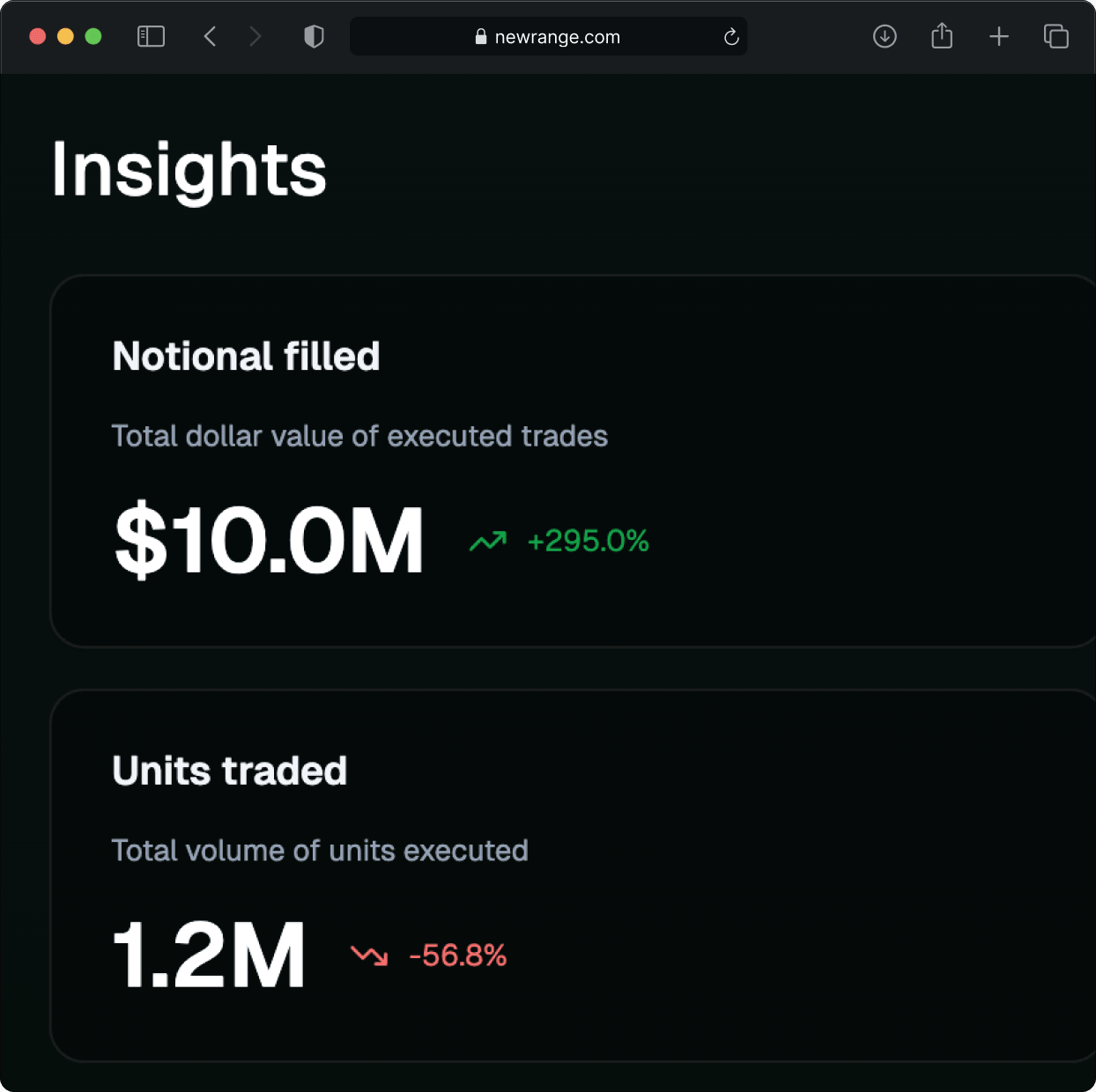

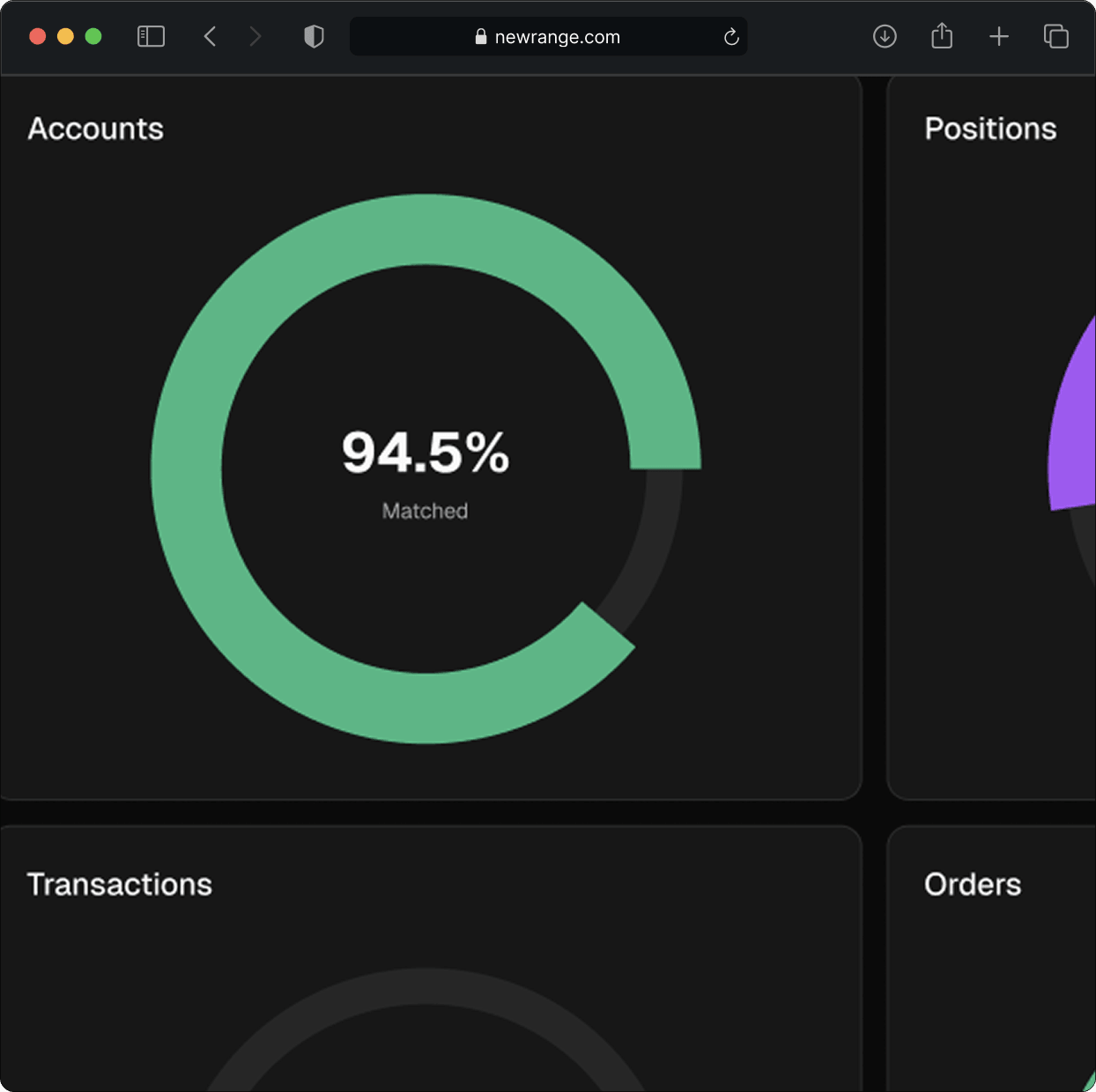

Data Reconciliation

Ensure Data Integrity Across Internal and External Systems

Accurate data reconciliation is essential to a strong compliance program. When different systems contain conflicting information, compliance failures follow. New Range's reconciliation engine ensures data consistency across your entire infrastructure

Key Benefits

Experience the New Range Platform

See firsthand how New Range can transform your firm's compliance and operations across trade reporting, best execution, surveillance, corporate actions, and data reconciliation. Schedule a personalized demo to explore platform features, ask questions, and discuss your specific requirements.

Schedule a demo